The Buzz on Pacific Prime

The Ultimate Guide To Pacific Prime

Table of ContentsThe Pacific Prime IdeasThe Best Strategy To Use For Pacific PrimeThe Basic Principles Of Pacific Prime Pacific Prime - The FactsThe smart Trick of Pacific Prime That Nobody is Talking About

Insurance policy is a contract, stood for by a plan, in which an insurance holder receives monetary defense or compensation versus losses from an insurer. The company pools clients' risks to make payments much more economical for the insured. Lots of people have some insurance coverage: for their car, their residence, their health care, or their life.Insurance likewise aids cover costs associated with obligation (legal obligation) for damages or injury created to a 3rd party. Insurance is a contract (plan) in which an insurer compensates an additional versus losses from particular contingencies or perils.

Investopedia/ Daniel Fishel Numerous insurance coverage kinds are readily available, and basically any type of individual or business can locate an insurer ready to guarantee themfor a rate. Typical personal insurance coverage types are auto, wellness, homeowners, and life insurance. A lot of individuals in the United States contend the very least among these sorts of insurance coverage, and automobile insurance coverage is called for by state legislation.

Facts About Pacific Prime Uncovered

Discovering the rate that is appropriate for you calls for some research. The policy limit is the maximum amount an insurance firm will pay for a covered loss under a policy. Optimums may be established per duration (e.g., yearly or plan term), per loss or injury, or over the life of the policy, likewise referred to as the life time optimum.

Plans with high deductibles are normally cheaper because the high out-of-pocket cost usually results in fewer small insurance claims. There are several types of insurance coverage. Let's consider one of the most important. Medical insurance aids covers regular and emergency clinical treatment expenses, typically with the choice to include vision and dental solutions separately.

Nevertheless, several precautionary services might be covered for free before these are satisfied. Medical insurance might be bought from an insurer, an insurance policy representative, the federal Medical insurance Industry, offered by a company, or federal Medicare and Medicaid coverage. The federal government no more needs Americans to have wellness insurance coverage, however in some states, such as The golden state, you may pay a tax obligation penalty if you do not have insurance coverage.

The Pacific Prime Diaries

Instead of paying of pocket for vehicle crashes and damages, people pop over to these guys pay yearly costs to a vehicle insurance policy company. The company then pays all or a lot of the covered expenses connected with a car accident or various other vehicle damage. If you have a leased lorry or borrowed money to get an auto, your lending institution or leasing car dealership will likely need you to bring car insurance policy.

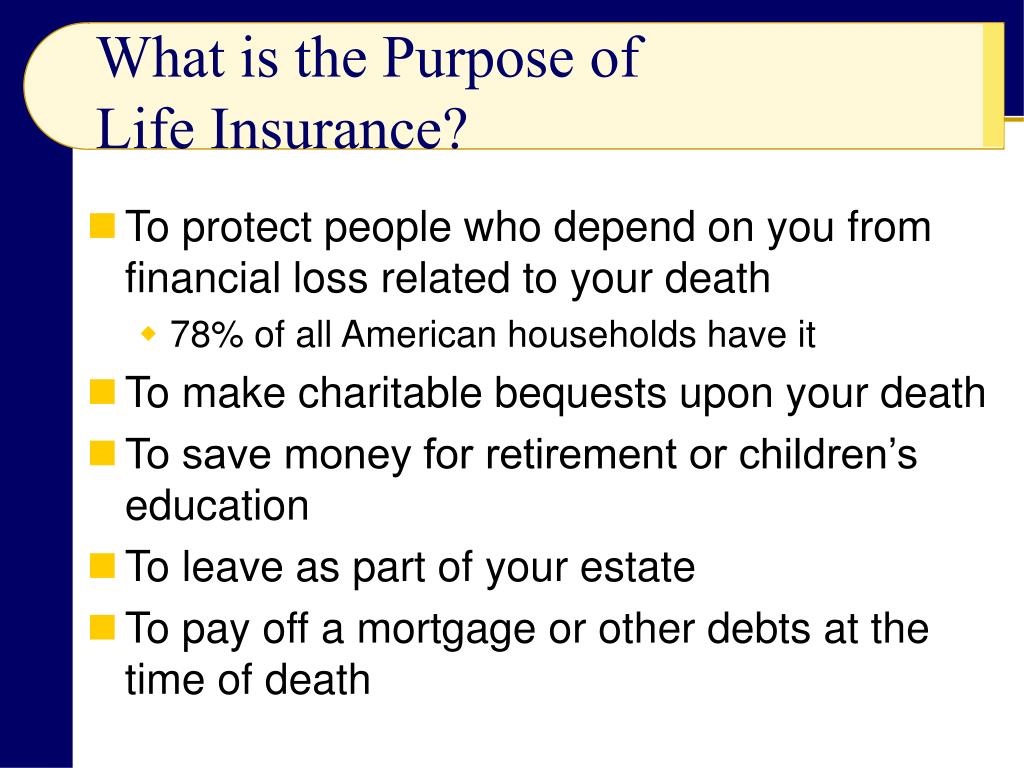

A life insurance plan assurances that the insurer pays a sum of cash to your beneficiaries (such as a spouse or kids) if you die. There are two major kinds of life insurance policy.

Permanent life insurance policy covers your whole life as long as you proceed paying the costs. Travel insurance covers the prices and losses associated with traveling, including trip cancellations or delays, insurance coverage for emergency situation wellness care, injuries and discharges, harmed baggage, rental cars, and rental homes. Also some of the ideal traveling insurance policy companies do not cover terminations or delays due to weather, terrorism, or a pandemic. Insurance policy is a way to handle your financial threats. When you purchase insurance policy, you buy protection against unexpected monetary losses. The insurance coverage business pays you or a person you select if something poor takes place. If you have no insurance and a mishap happens, you might be responsible for all related expenses.

Not known Details About Pacific Prime

There are many insurance plan kinds, some of the most typical are life, health, property owners, and car. The right sort of insurance for you will depend on your goals and monetary situation.

Have you ever had a moment while considering your insurance coverage policy or shopping for insurance coverage when you've thought, "What is insurance policy? And do I really need it?" You're not alone. Insurance can be a strange and perplexing point. How does insurance work? What are the advantages of insurance policy? And exactly how do you locate the very best insurance policy for you? These are typical questions, and luckily, there are some easy-to-understand solutions for them.

Experiencing a loss without insurance coverage can put you in a hard monetary situation. Insurance is a crucial economic tool.

The Facts About Pacific Prime Revealed

And sometimes, like automobile insurance policy and workers' payment, you might be called for by law to have insurance policy in order to shield others - international health insurance. Learn more about ourInsurance alternatives Insurance is essentially a massive nest egg shared by lots of people (called policyholders) and handled by an insurance policy provider. The insurance business makes use of money gathered (called premium) from its policyholders and other investments to spend for its operations and to fulfill its guarantee to insurance policy holders when they file a case